You can get around capital gains tax by selling the house.

It’s an unattainable and complicated cost, but real estate investors can legally avoid or minimize paying taxes by using the following checklist of strategies.

Definition: What is a Capital Gains Tax?

These earnings are tax-deductible when an individual sells an property for a profit or gain. Particularly with real estate where the buyer pays an amount that is an amount called Capital Gains Tax.

The most commonly used kinds of capital gains are bonds, stocks, property as well as precious metals.

In California the long-term capital gain tax typically 32.1 percent. This includes taxation on Affordable Health Care Act (ACA), IRS (15 10 percent), California (13.3%) as well as Health Care (3.8%). This is the typical couple’s tax bracket for married couples within the 25% tax bracket.

You could retain more of your hard-earned cash by gaining experience and guidance from a knowledgeable real estate agent.

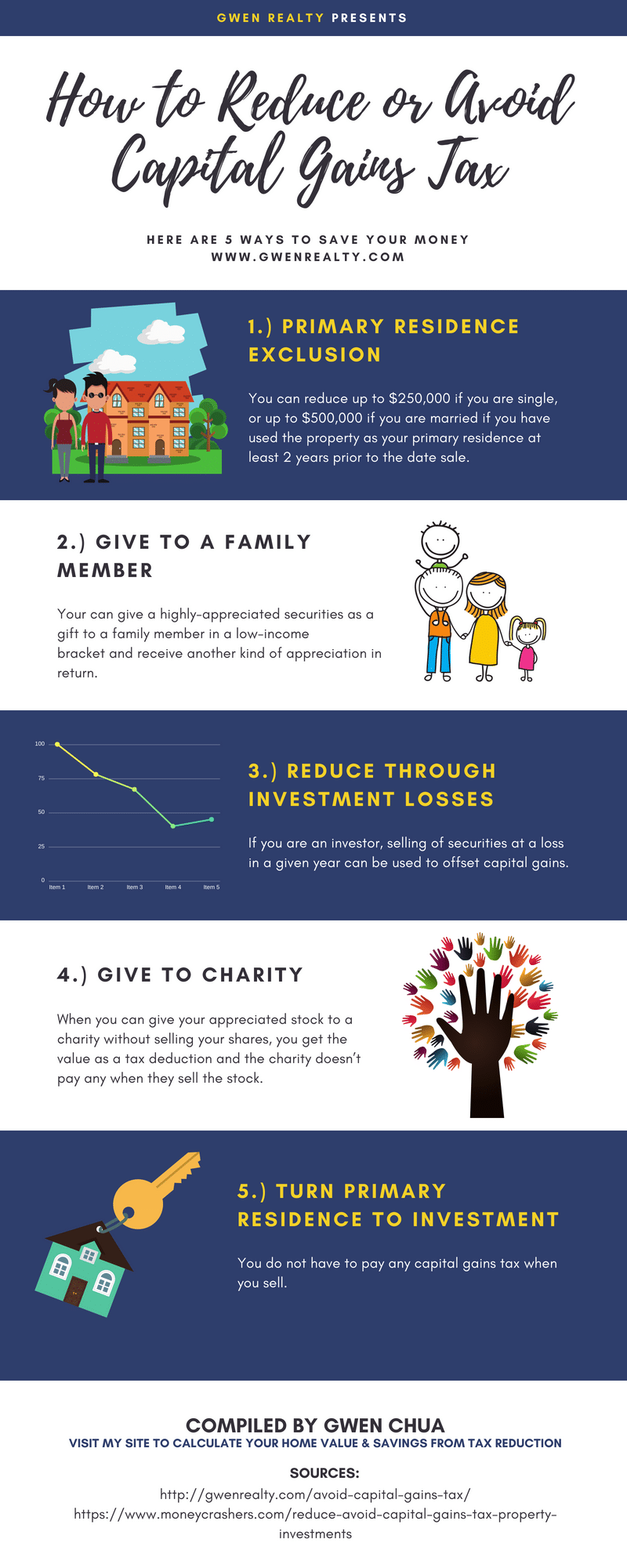

1. Exclusion for Primary Residence

You can reduce your capital gains obligations in the event that you’ve used the property as your principal residence. The tax exclusion is up to $250,000 for homeowners living on their own or $500,000 for couples, upon being able to pass the test for homeownership. The test requires being able to meet the requirements of becoming a resident of the home for two years within 5 years preceding the date of the sale.

2. Tax-Deferred Exchange (1031 Exchange)

Also called Starker Exchange. The tax exemption was built on the section 1030 of the United States Internal Revenue Code and was subsequently referred to as 1031 Exchange. This exemption allows taxpayers to delay the payment of capital gains on properties exchanged which are used for trade, investment, or for business reasons.

What exactly is the definition of an “exchanged property?” It is the process of rolling proceeds of the sale into a similar rental investment. Properties that are used as investment or rental properties can benefit from this exclusion.

Properties that are rental income and were used as primary residences prior to the tax year could also be eligible for exclusion under certain restrictions.

3. Deferred Sales Trust

You may defer taxation using this method if you decide to sell a personal or investment property.

4. Home Renovation

Home investors who are smart buy a house that is priced below market value and then make it their main home while they make the work. Then, they sell it at a more favorable selling price, but without paying capital gains tax, thanks to the exclusion of primary residences.

5. Transfer property ownership to family members in the low-income bracket

It is possible to give appreciated securities to a family member who is in an income bracket that is low and receive another form of appreciation in exchange. The IRS permits if the family decides to sell the property, the tax rate of their income rate will be applied instead of yours.

The tax rate will be based according to the income bracket of each individual. If, during the year that you sell the property, the family member falls in the 10 to 15 percent tax bracket for ordinary income the person could get away with capital gains tax completely.

6. Reduce Taxes via Investment Losses

If you’re an investor and sell securities for a loss during an upcoming year could be used to reduce capital gains. It is possible to use losses in value of those Mutual funds to lower the liabilities of those securities that have realized gains.

7. Give to charity

If you donate the appreciated stock to a charity, without selling the shares, you receive the price to deduct tax and the charity does not have to have to pay any tax when selling the stock.

The above list of ways to minimize capital gains. It was that was compiled by an old-time Foster City resident as well as Intero Realtor, Gwen Chua. He works in conjunction with San Francisco Chapter of the California Society of Tax Consultants (CSTC) to assist sellers defer or reduce the tax on capital gains they pay.

If you’re looking to find out the value of your home and to get more value when selling your house, Gwen is a well-established agent in the real estate industry that specializes on Foster City, Redwood, San Mateo, Millbrae & South San Francisco properties. He takes continuing education classes at members of the San Francisco Chapter of the California Society of Tax Consultants each month. CPAs, accountants, CPAs, and EAs attend these meetings and share an abundance of knowledge and knowledge.

If you want to know your home value and save more in selling your home, click here.

Gwen Chua

Intero Real Estate Services

650-255-1511

gchua@intero.com

Gwen is a seasoned agent in real estate business specialising in Foster City, Redwood, San Mateo, Millbrae & South San Francisco properties. He attends continuing education classes with the San Francisco Chapter of the California Society of Tax Consultants on a monthly basis. Accountants, CPAs, and EAs attend these meetings and provide a wealth of information and experience.

About Intero Real Estate Services

Intero Real Estate Services, Inc., a Berkshire Hathaway affiliate and wholly owned subsidiary of HomeServices of America Inc., serves Northern California with 13 offices throughout the greater Silicon Valley. The Intero Franchise network is comprised of nearly 50 affiliates located in Alabama, Arizona, California, Colorado, Nevada, Tennessee and Texas.

The company is headquartered in California’s Silicon Valley.

About California Society of Tax Consultants

The California Society of Tax Consultants, Inc. (CSTC) has been a nonprofit organization for the benefit of tax professionals throughout California since 1966. Programs cover a wide spectrum of tax topics that are approved for CTEC, EA & CPA credit.